LIC Jeevan Lakshya Policy an endowment plan that is participating in Bonus, which provides both investment and insurance benefits. Since it is a participating plan, bonus benefits will be available. In this Plan in case of death of the policyholder a regular income is provided to the nominee that may help to full fill the basic needs of the family and children education, also provide Maturity benefit in addition to a lump sum at the date of Maturity. There are some additional benefits that you can take it as a rider. We will explain the benefits of this plan with the help of a few examples.

| Policy Type | Endowment |

| Jeevan Lakshya Plan Table No. | Table No. 933 |

| Launch Date | 1st Feb 2020 |

Key Feature & Benefits of Jeevan Lakshya Policy

When Customer purchase the LIC Jeevan Lakshya Plan, He /she can decide on the following Benefits:

Basic Sum Assured:

This is the amount of cover that you want. You can choose a minimum amount of Rs. 1,00,000 and thereafter in a multiple of Rs. 10000. In this plan There is no upper limit.

Policy Term:

Policy term decides the period for which you wish to have the cover. You can Choose Policy term as per your suitability it can be anywhere between 13 to 25 years.

Premium Payment Term:

Policy Premium Paying term is the term that you need to pay the premium. In this Plan, it is Policy Term minus 3 years.

Premium:

Your annual premium will be decided based on the basic sum assured that you Choose & your age and the policy term that you have selected.

Since it is a Participating plan, you will receive at maturity Simple Reversionary Bonus and Final Additions bonus each year declared by LIC.

Other benefits in the LIC Jeevan Lakshya Plan:

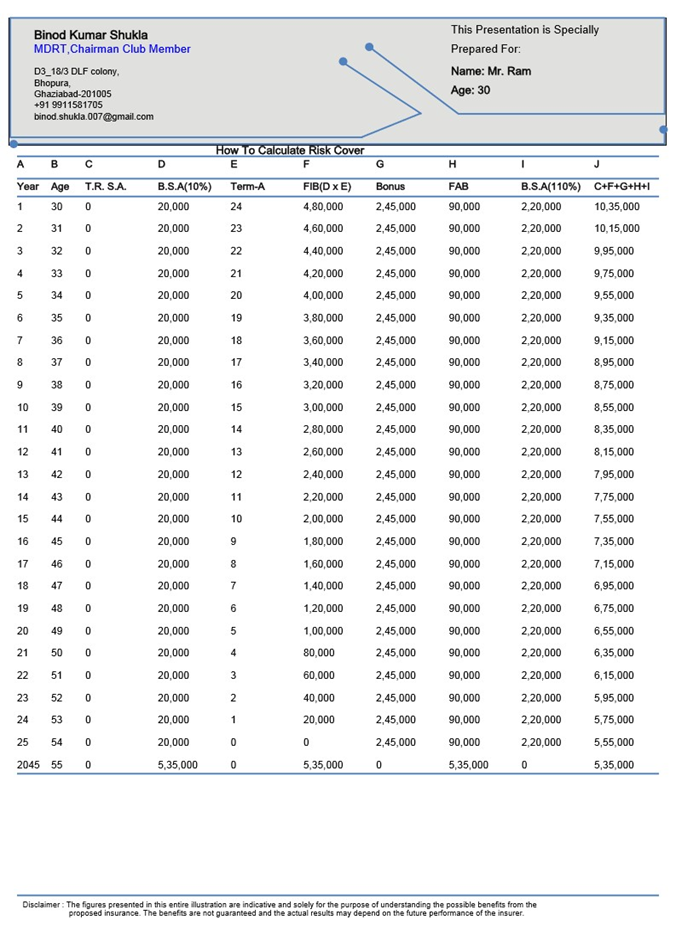

Death Benefit in Jeevan Lakshya Policy:

In case unfortunate death of the policyholder before the end of the policy term, the nominee or legal heir will receive all the following:

- 10% of the Basic Sum Assured as an Annual Income Benefit from the immediate policy anniversary date to the policy Maturity Date. We will explain this better in the example.

- 110% of the Basic Sum Assured payable on the Maturity Date.

- Simple Reversionary Bonus which has accrued throughout the policy term that LIC declared every year payable on the Maturity Date.

- Final Addition Bonus if declared payable on the Maturity Date

The Death Benefit shall not be less than 105% of all premiums paid as on date of death of the policyholder.

Maturity Benefit in LIC Jeevan Lakshya Plan:

At the end of the policy term, the policyholder will receive the following benefits.

- Basic Sum Assured + Simple Reversionary Bonus and Final Addition Bonus if declared

LIC Jeevan Lakshya Plan with an Example:

We have Naina Mittal, age 30 who wishes to buy this plan. He goes in for the plan with the following:

Sum Assured – Rs. 5,00,000

Term – 25 years

Premium Payment Term = 25 – 3 = 22 years

Based on these parameters, his annual premium is Rs. 20879 + GST Rs 940. Total Premium Rs. 21819. Here we have assumed the current tax rate of 4.5%.

Death Benefit:

Scenario 1:

If Naina Mittal dies after 4 policy years.

In 4 years, he would have paid Rs. 87,276 as premiums. The Sum Assured of his plan is Rs. 5,00,000.

His nominee will get the following benefits:

- Annual Income Benefit of 10% of the Basic Sum Assured – Rs. 50,000. At the end of the 4th year, the nominee will get Rs. 50,000. This amount would be paid every year until maturity.

- 110% of Sum Assured – Rs. 5,50,000. At the end of the 25th year, the nominee will get Rs. 5,50,000.

- Along with the Rs. 5,50,000. the Simple Reversionary Bonus which has accrued in the plan along with any Final Addition Bonus will also be paid to the nominee.

Scenario 2:

If Naina Mittal dies after 15 policy years

In 15 years, he would have paid Rs. 3,27,285 as premiums. The Sum Assured of his plan is Rs. 5,00,000.

Her nominee will get these followings benefits

- Annual Income Benefit of 10% of Sum Assured – Rs. 50,000. At the end of the 15th year, the nominee will get Rs. 50,000. This amount will be paid every year till the Maturity.

- 110% of Sum Assured – Rs. 5,50,000. At the end of the 25th year, the nominee will get Rs. 5,50,000.

Along with the Rs. 5,50,000. the Simple Reversionary Bonus which has accrued in the plan along with any Final Addition Bonus will also be paid to the nominee at Maturity.

Scenario 3:

If Naina Mittal survives till the end of the policy term of 25 years – Naina Mittal will get the Sum Assured + Simple Reversionary Bonus + Final Addition Bonus as declared.

Total Premiums Paid = Rs. 4,70,148.

Sum Assured = Rs. 5,00,000.

Financial year 20-19-20 Simple Reversionary Bonus declared by LIC is Rs. 49 per 1,000 Sum Assured. Let’s assume it will be continuing till Maturity, there is no guarantee that this will be the bonus rate for all years.

Simple Reversionary Bonus = 49 x 5,00,000 / 1,000 for 25 years = Rs. 6,12,500.

Again, let us assume a Final Addition Bonus of Rs. 2,25,000.

So Naina Mittal will get Rs. 5,00,000 + Rs. 6,12,500 + Rs. 2,25,000= Rs. 13,37,500.

Check the Bonus rates of LIC Policy

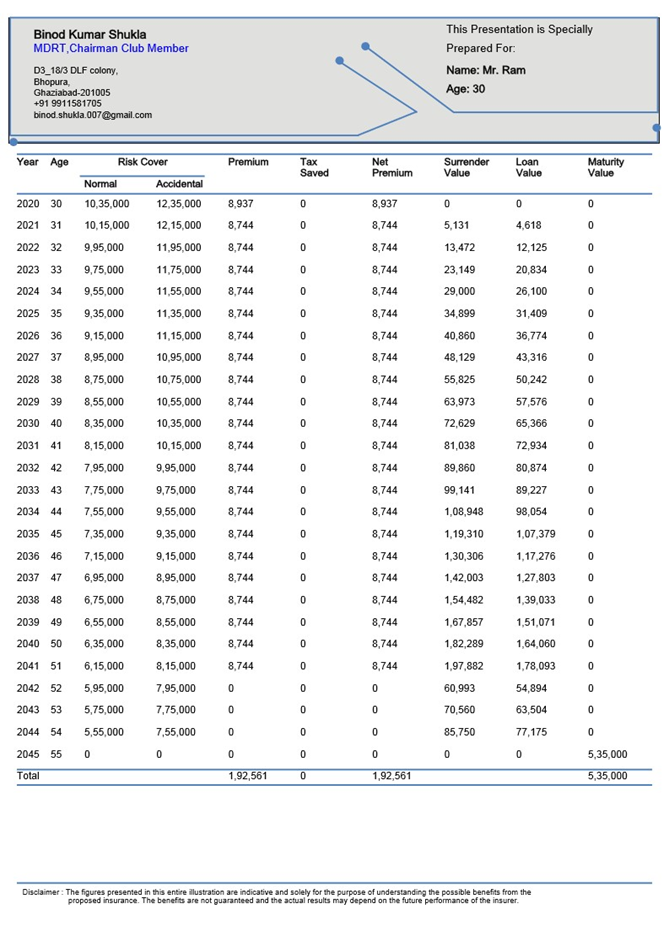

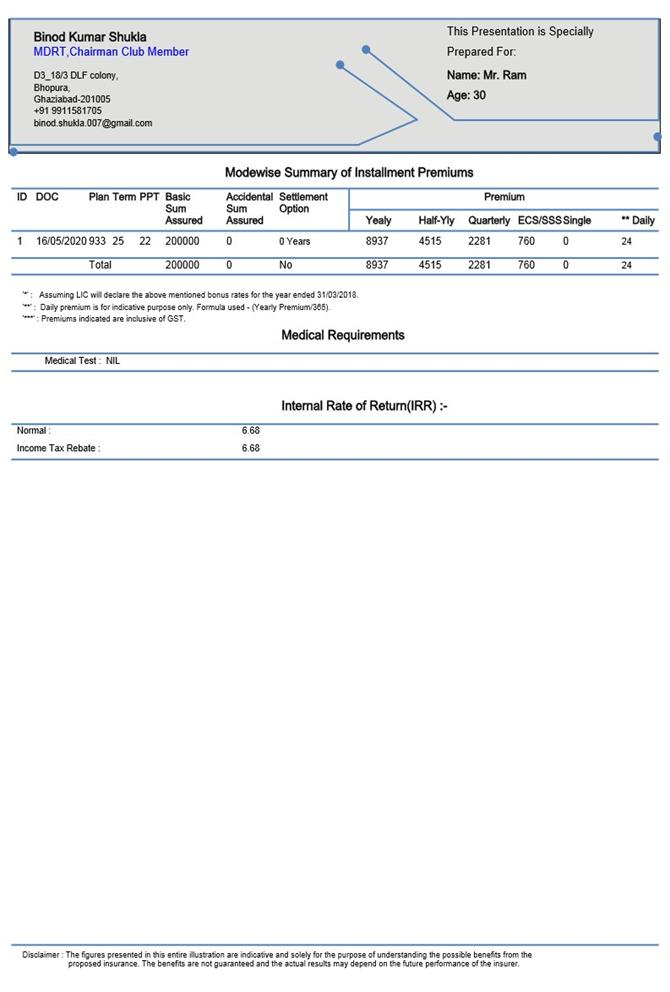

Sample Premium Illustration of LIC Jeevan Lakshya Policy:

Here are the sample tabular premium rates (inclusive of taxes) payable by a healthy, non-tobacco user male for 30 Years age, Sum Assured, and policy term. We have gone with the current applicable tax rate of 4.5% and current Bonus Rate Rs 49/1000 and FAB for such policy and assuming the same will continue till maturity.

Sum Assured: 2,00,000

Age : (30) Years

Policy Term: 25 Years

LIC Jeevan Lakshya Policy at a Glance:

| Minimum | Maximum | |

| Sum Insured | 1,00,000 | No Limit |

| Policy Term | 13 Years | 25 Years |

| Premium Payment Term | 10 Years Policy Term-3years | 22 years |

| Entry Age | 18 Years | 50 Years |

| Maturity Age (nearest birthday) | 31 Years | 65 years |

| Premium paying frequency | Monthly(NACH), Quarterly, Half Yearly | Yearly |

Tax Rebate in LIC Jeevan Lakshya Plan:

- Premiums – The premiums paid for the Jeevan Lakshya plan are exempt from taxation under Section 80C of the Income Tax Act 1961.

- Maturity Claim – Maturity amount is exempted from Income tax u/s 10(10D) of the Income Tax Act 1961

- Death Claim – Death claims received under the plan are free from taxation under Section 10(10D) of the Income Tax Act1961

Some Other Benefits in the LIC Jeevan Lakshya Plan:

- Free-look Period – If the policyholder is not happy with the policy term and condition, he can cancel the policy within 15 days of the received documents. This period is called the free-look period. Upon cancellation, Mortality Charges will be applicable as per prodata base.

- Grace Period – 3o days grace period from the premium due date for Yearly, Half-yearly, and Quarterly premium payment mode.

- Loan – You can avail of a loan against this policy after 2 years of premium paid.

- Riders – You have the choice of taking the following rider by paying an extra premium amount.

- LIC’s Accidental Death and Disability Benefit Rider.

- LIC’s New Term Assurance Rider.

Surrender Value:

If you surrender or discontinue policy before the paying of 2 years premium, you will not be paid anything back. In case you have paid at least 2 years premiums, the policy will acquire a Surrender Value.

Paid-up Value Calculation if you stop paying your premiums in the Jeevan Lakshya Plan?

The policy will acquire a Paid-Up Value in case you stop paying future premiums after the grace period also. Paid-up Value of Jeevan Lakshya Plan will only be available if at least 3 years’ premiums have been paid.

. The plan will not have any additional bonus accruals.

- The plan will not have any additional bonus accruals

- The Death Benefit would be as following:

- (No. of premiums paid / Total no. of premiums payable) x (110% of Basic Sum Assured + Accrued bonus).

- 10% of Basic Sum Assured x (No. of premiums paid / Total no. of premiums payable) as an Annual Income Benefit from the next policy anniversary date to the policy anniversary date one year before the Maturity Date.

- The Maturity Benefit would be as follows:

- (No. of premiums paid / Total no. of premiums payable) x (Basic Sum Assured + Accrued bonus).

If you have any questions on the LIC Jeevan Lakhsya Policy, drop in a line in the comments and we will be happy to help out