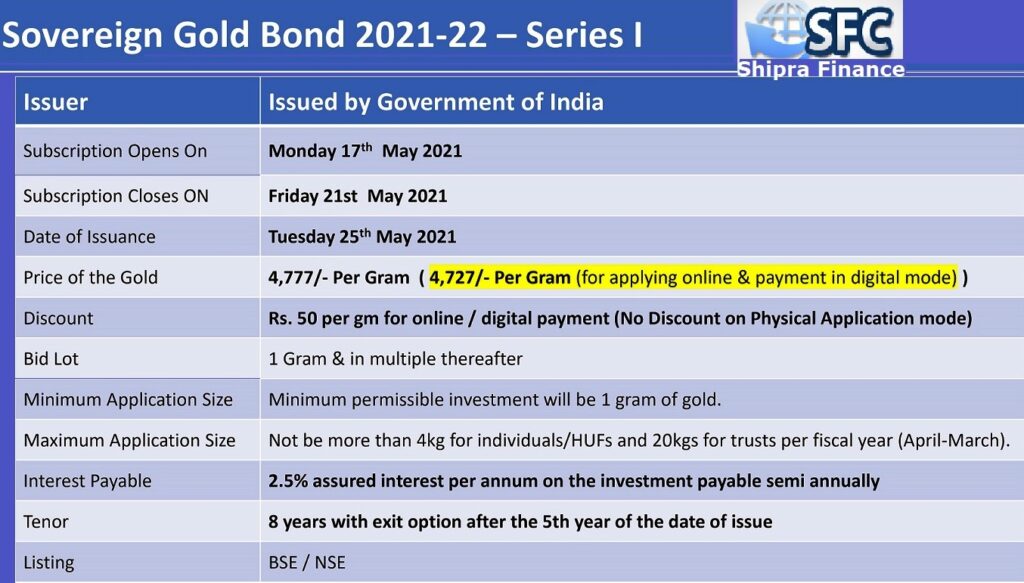

The central government, in consultation with the Reserve Bank of India (RBI), decided today to issue the program for the Sovereign Gold Bonds Scheme 2021-22. The Sovereign Gold Bonds Scheme 2021-22 will be issued in six tranches from May 2021 to September 2021. According to a statement released by the Treasury Department on Wednesday, May 12th, the first tranche of the Sovereign Gold Bonds Scheme will be subscribed for. The 2021-22 period will open on May 17, 2021, and end on May 21, 2021, with a period of remains open for five days.

Gold bonds will be sold through scheduled commercial banks, with the exception of small financial and payment banks, designated post offices, stock exchanges known as Bombay Stock Exchange Limited and the National Stock Exchange of India, and Stock Holding Corporation of India Limited.

The date of issuance shall be as per the details given in the Calendar FY 21-22 below

| Serial No | Tranche | Dates of Subscription | Date of Issuance |

| 1 | SGB 2021-22 Series-1 | 17 May to 21 May 2021 | 25 May -2021 |

| 2 | SGB 2021-22 Series-2 | 24 May to 28 May 2021 | 01 June -2021 |

| 3 | SGB 2021-22 Series-3 | 31 May to 04 June 2021 | 08 June -2021 |

| 4 | SGB 2021-22 Series-4 | 12 July to 16 July 2021 | 20 July -2021 |

| 5 | SGB 2021-22 Series-5 | 09 August to 13 August 2021 | 17 August -2021 |

| 6 | SGB 2021-22 Series-6 | 30 August to 03 September 2021 | 07 September -2021 |

Why invest in Sovereign Gold Bond?

The safest way to buy and store gold

Earn 2.5% assured interest per annum on the investment payable semi-annually

Asset appreciation opportunity plus assured interest

Issued by the Government of India.

Trade able on Stock Exchange

No TDS applicable

Can be used as collateral for Loans*

The bonds will be available both in demat and paper form.

Indexation benefit if the bond is transferred before maturity

No Capital Gains Tax on redemption

Rate of Interest

The Sovereign Gold Bonds offer an interest rate of 2.50% per annum payable semi-annually and the same will be credited in bank account semi-annually.

Eligibility

Resident Indian entities including Resident Individuals, HUFs,

Trusts, Universities, Charitable trust Institutions, and also minors applying (through their guardian).

Minimum Subscriptions

1 unit, i.e. 1 gram of gold.

Maximum Subscriptions limit

4 Kgs for Individuals/HUFs and 20 kgs for trusts per Financial Year

Tenor

The bond will be for a period of 8 years with an exit option after the 5th year of the date of

issue and such repayments shall be made on the next interest payment dates.

Redemption price

Government bonds can be redeemed for cash at the end of the investment cycle. Redemption

Will be held at the prevailing gold price (based on the simple average of the final average price of 999 gold)

Purity published by IBJA, 3 business days from the date of repayment), de

Depreciation due to investor bond value plus capital valuation/increase/decrease in the gold price

Premature Redemption

From the 5th year, investors can approach the concerned bank/Post Office/agent thirty days before the

coupon payment date.

Request for premature redemption can only be entertained if the investor approaches the concerned

bank/post office at least one day before the coupon payment date from the 5th year, investors can approach the concerned bank/Post Office/agent thirty days before the coupon payment date.

Request for premature redemption can only be entertained if the investor approaches the concerned

bank/post office at least one day before the coupon payment date From the 5th year, investors can approach the concerned bank/Post Office/agent thirty days before the coupon payment date.

Liquidity

Liquidity is available in secondary markets because these bonds have a listing mandate

BSE and NSE. However, the liquidity of previous editions is very low, and only a few

tranches. Most of the latest SGB series are sold at a discount to the price of gold

lack of liquidity and depth in the market

Nomination

Nomination and cancellation Facility available, Nomination and its cancellation shall be made in Form ‘D’ and Form ‘E’, respectively

Loan

Loan Facility Available. The loan-to-value (LTV) ratio is to be set equal to the ordinary gold loan mandated by the Reserve Bank from time to time.

Transfer Facility

The Bonds shall be transferable by execution of an Instrument of transfer as in Form ‘F’.

Taxation

Interest on bonds will be taxable under the provisions of the Income Tax Act 1961.

Excluding tax on capital gains (excluding redemption). Physical gold (20% tax after indexed discount if held for three years). TDS is not applicable at Source at Interest income/bond redemption. A person free of capital will have the redemption of these sovereign gold bonds income tax. Anyone will have long-term capital gains when transferring government bonds You are entitled to index benefits.

How to Buy?

It’s very simple. Just fill in the form below and enter the number of units you want to buy – One unit equals one gram of gold. You will be informed about the price of the units which have been declared by the RBI on the issue date.

We will send you the ‘Invest Online’ Link for making the final payment! That’s it. Still, you can call us freely for any help