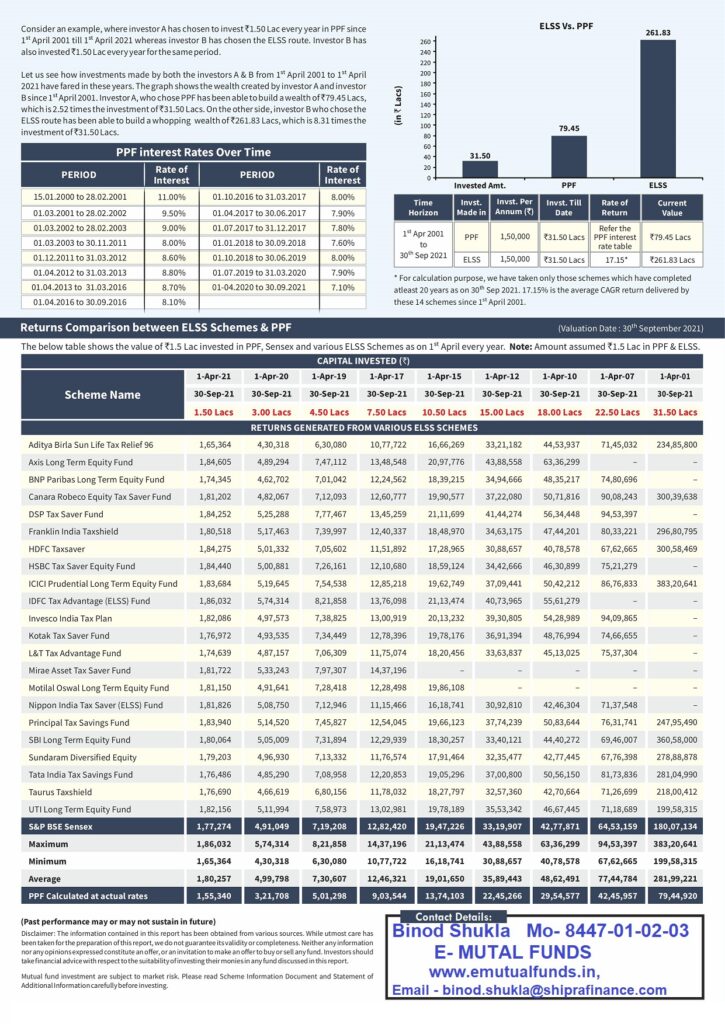

PPF vs ELSS( Tax Saving Mutual Fund)

Many people want to know which is the best tax saving option ELSS (Equity Linked Saving Scheme) or PPF. Let us know differences of return between ELSS & PPF for tax saving.

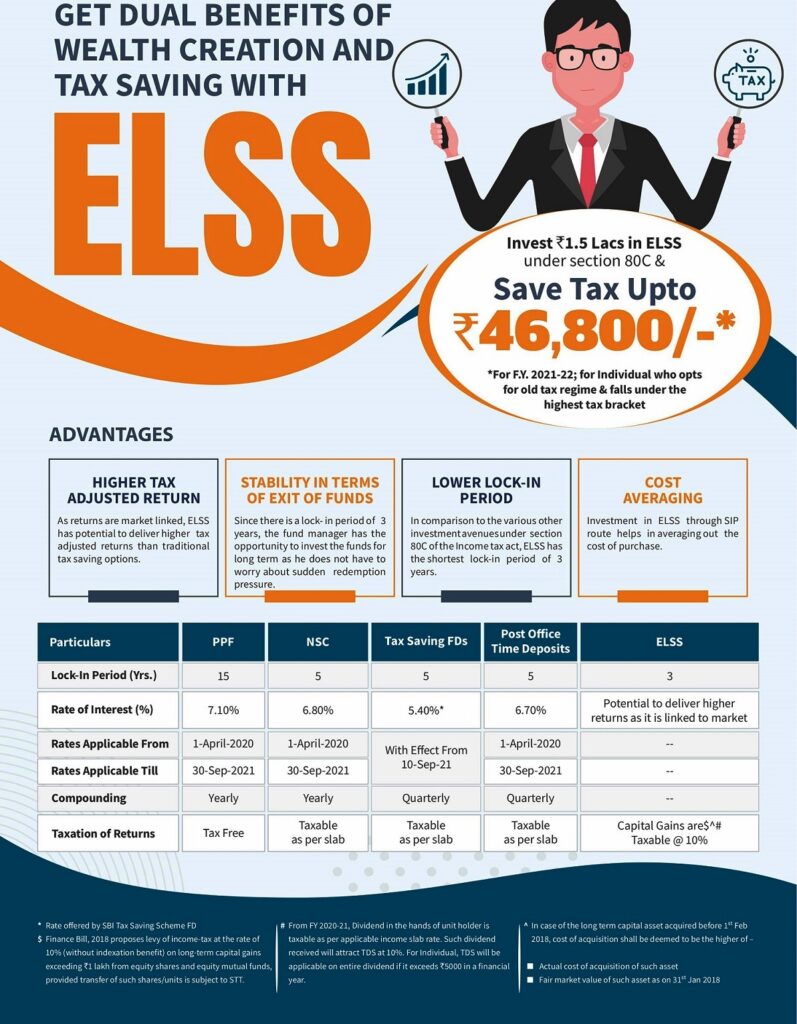

ELSS (Equity Linked Savings Scheme) and public provident fund PPF, both help you save taxes, but apart from that, they differ on many parameters. ELSS investment depends on equity and has higher volatility compared to PPF which is a debt instrument with very less volatility. Both ELSS and PPF, you can get a maximum deduction of INR 1.5 Lakh U/S 80C of the Income Tax Act, 1961.

Many people ask about PPF vs ELSS for making tax-saving investment decisions. So, let’s understand and compare ELSS mutual funds and PPF for their suitability.

What is ELSS (Tax Savings Mutual Fund) funds?

ELSS Mutual Fund serves double purpose, not Only saving taxes also help you create long term wealth. ELSS funds generate returns by investing in equity and equity-related instruments. This makes it a suitable investment option for a person that have risk appetite capacity and have passions and achieve long term goals.

Investor can get a combination of the highest gain of 14% and above, as well as the lowest lock-in period of 3 years by investing in tax saving Scheme so it is a best investment option when compared to other options with tax deductions u/s 80C of the Income Tax Act, 1961.

PUPLIC PROVIDEND FUND (PPF)

PPF is a Central Government backed debt Scheme, it is suitable for long terms financial goals such as children’s education and retirement planning. By investing in PPF, you can claim tax deductions under section 80C up to Rs 1.5 lakh.

PPF have a longer lock-in period of 15 years and you can also extend it further for another 5 years and also there is a premature withdrawal facility after 6th year onwards.

Loan Faciality also available in PPF account and that facility is available from the 3rd to the end of the 6th financial year. The loan amount is set at 25% of the outstanding balance amount of the two preceding years and needs to be repaid in 36 months. However, It is to be noted, that the interest charged is 2% over the present interest rate.