Different Types of Bonus Declared by LIC?

The LIC describes different types of bonuses in the policy, and they are named differently depending on the plan’s performance pattern. The most common types of bonuses are explained below

Simple Reversal Bonus

Simple Reversionary Bonus is declared each year and added to Policy Holder “Insurance account” and is only (fully) available if the policyholder quits in the form of a maturity date or death. If you decide to cancel the policy on the way (by submitting the policy), you will only receive a portion of the total bonus, depending on the cancellation amount available at that time.

Final Additional Bonus (FAB)

Final Extra Bonus is a one-time bonus that is paid along with the dates of participating (profitable) policies and The FAB is paid in addition to the simple Reversionary bonus that declared and added to Policy Holder Insurance account. The final additional bonus paid once per policy. This will result in claims that are due to maturity or discount, (return of policy one year before the due date) or claims due to death.

Loyalty Addition (LA)

Loyalty Additions are paid as a one-off benefit rather than a simple reversal bonus (SRB). The main difference is that unlike simple repayment bonuses. It is part of the Insurance benefit when it is declared. policyholders only have loyalty Addition when they terminate their policy. In other words, the addition of declared royalties only applies to policies that terminate by death, delivery, or Maturity date. According to the terms of the Plan in the declared year.

How to Calculate LIC Bonus?

Bonus rates are declared by the LIC as simple reversal bonuses. The bonus rate thus explained applies to an insured amount of Rs. 1000 for each plan of every year.

Example

The 21-year New Endowment (Plan-914) bonus rate is Rs 48 per 1,000. Suppose this policy applies to the insurance amount of Rs. 10.00,000.

The bonus for each year is 10.00,000 x 48 / 1000-> Rs. It is 48,000.

Bonuses declared this way are added at maturity for all years up to the maturity date to determine the simple payback bonus portion of the maturity return.

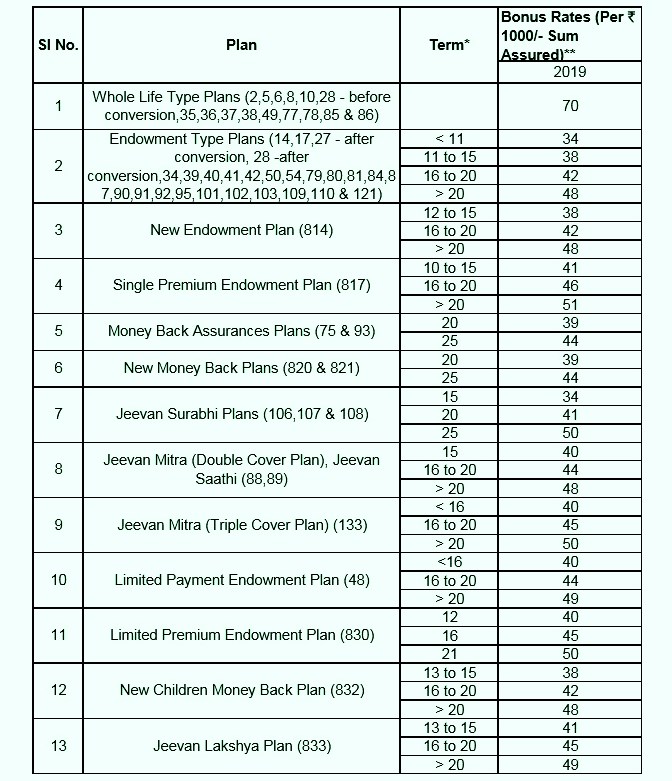

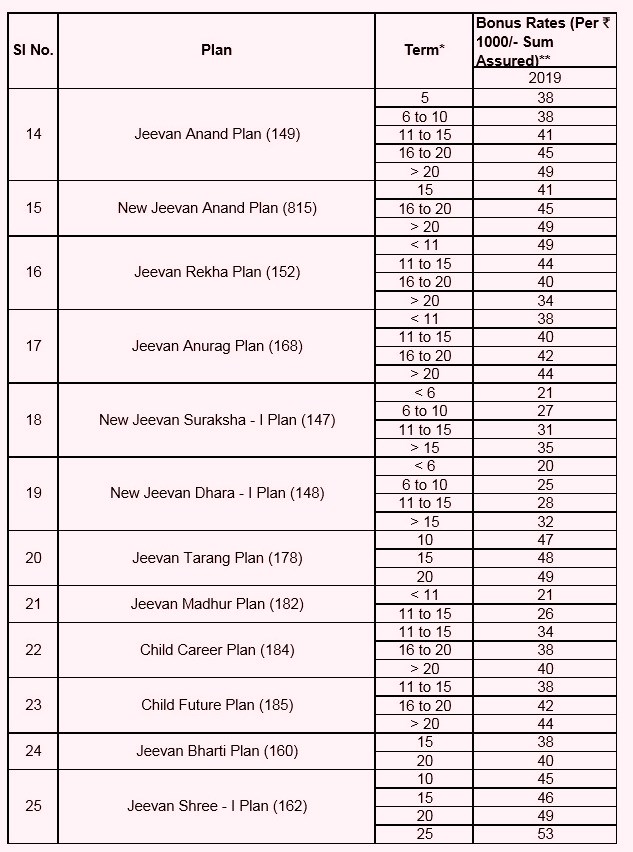

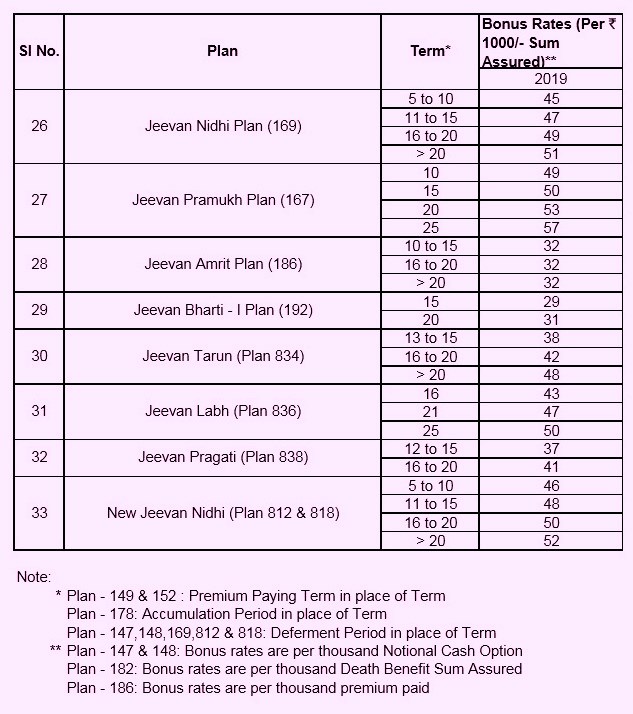

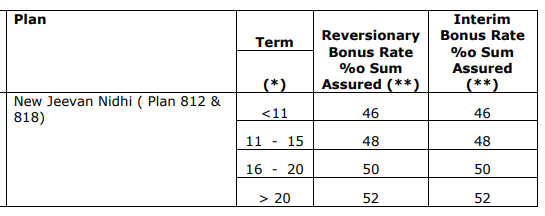

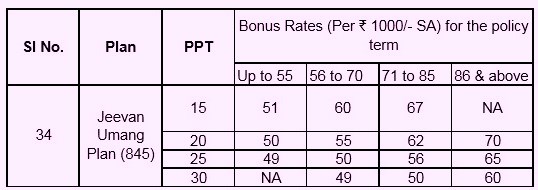

Here you can see the latest bonus rates, specified for all active and closed plans that are participating in bonus.

Table of Bonus Rate LIC FY- 2019-20

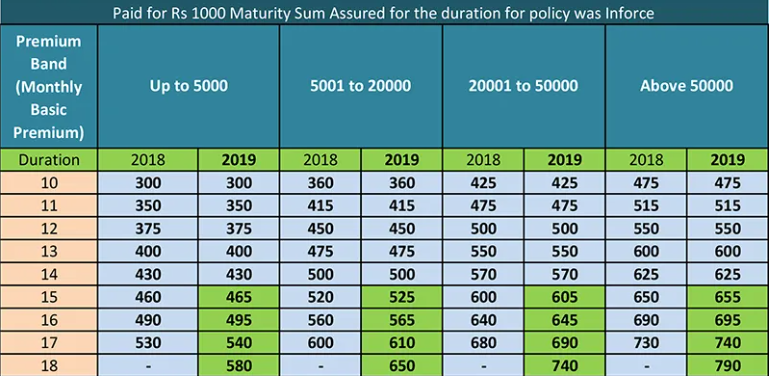

Final Addition Bonus

The final additional bonus will be paid for a claim due to maturity (including discounted claims) or death. The policy is fully enforced and insurance premiums have been paid for over 15 years.

The final (additional) bonus rates are as follows:

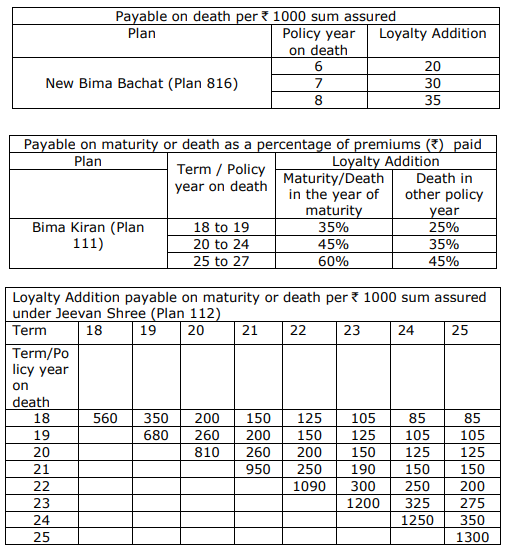

Loyalty Addition Rates of LIC Most Popular Plan

New Bima Bachat Table- 816, Bima Kiran Table -811, LIC Jeevan Shree Table -112,

Disclaimer :

I have taken the utmost care when entering the bonus rates, but please consult the LIC branch in case of any error.