Are You Afraid of the Market Volatility?

We all know that 70% of our planet is covered in water. However, it is also known that only a small part of it is freshwater and useful plants and human life. A small amount is even accessible from the freshwater there and much of which is enclosed in glaciers and snowfields.

This has led to numerous programs and ideas for conserving freshwater and ensuring long life. Given the environmental problems, the world is facing so the task is difficult.

Investment opportunities are no different. There are several ways that evolve day by day. As investors, however, most of us need very few of these complex concepts, but only a few stable, easy to understand, and workable ideas.

It is important to feel committed to these concepts and to conduct the course. When looking for higher returns, we often forget what has been said above, and this leads to salting portfolios.

Here are some ideas that give freshness to one’s portfolios: Asset allocation Fund that works in all types of market Bearish or Bullish and gives a decent tax-adjusted return.

DSP Dynamic Asset Allocation Fund

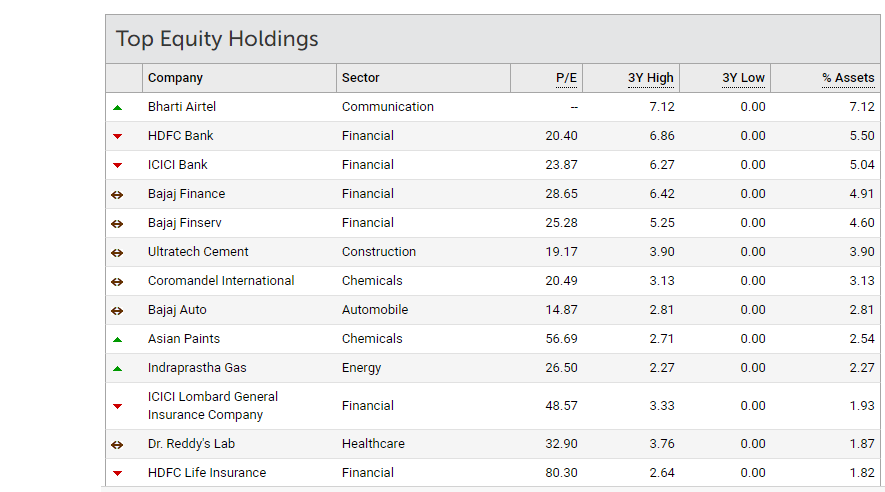

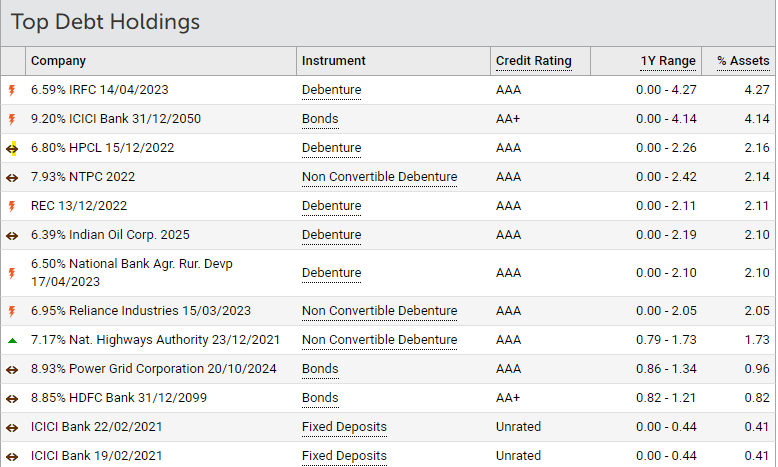

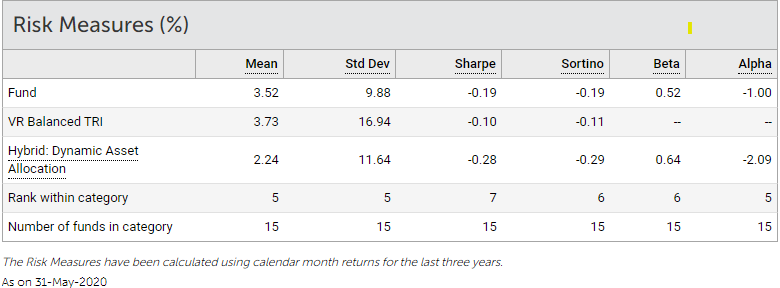

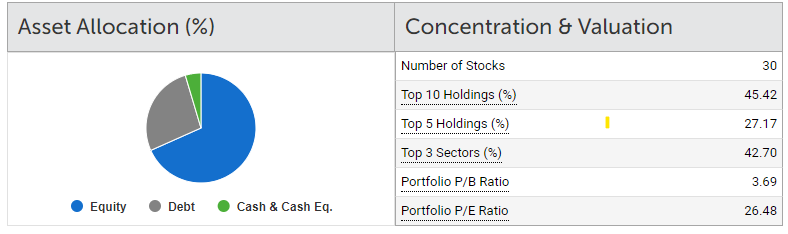

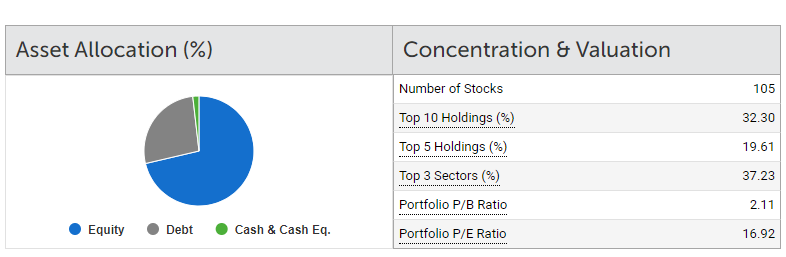

As on date, 17/06/2020 Fund has 68.34% investment in Indian stocks of which 51.19% is in large-cap stocks, 10.52% is in mid-cap stocks, 1.13% in small-cap stocks. Fund has 24.58% investment in Debt of which, 24.58% in funds invested in very low-risk securities

Invest in this Scheme now Click Here

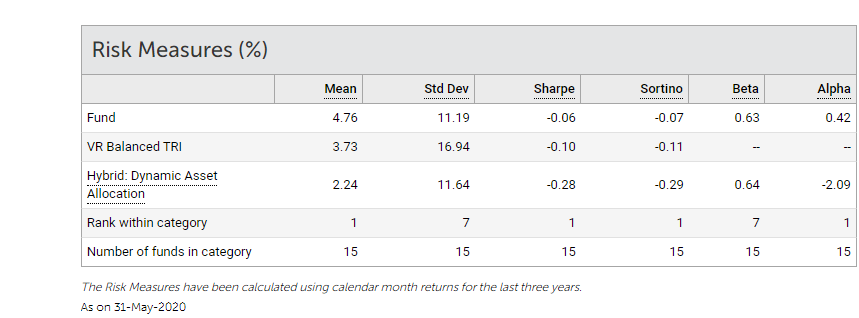

ICICI Prudential Balanced Advantage Fund.

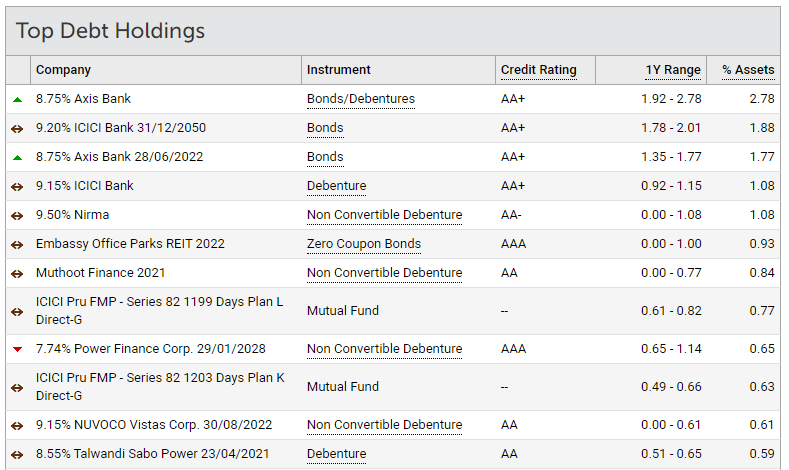

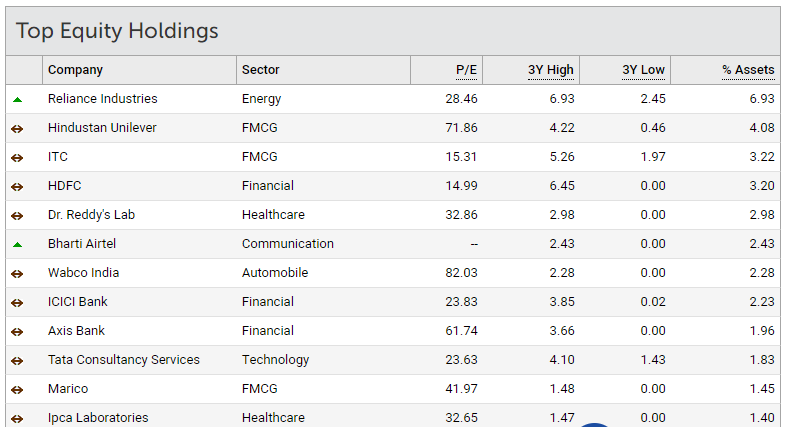

As on date 17/06/20, this Fund has invested 66.86% in Indian stocks of which 52.55% is in large-cap stocks, 6.86% is in mid-cap stocks, 2.32% in small-cap stocks. Fund has 25.28% investment in Debt of which 0.4% in Government securities, 23.37% in funds invested in very low-risk securities.

Investment in this fund Click here

Edelweiss Balanced Advantage Fund

This Fund has an investment in Indian stocks 63.55% of which 40.04% is in large-cap stocks, 16.79% is in mid-cap stocks, 3.45% in small-cap stocks. Fund has 13.23% investment in Debt of which, 13.23% in funds invested in very low-risk securities.

Disclaimer – Mutual Funds.

The recommendations and reviews do not guarantee fund performance, nor should they be viewed as an assessment of a fund’s, or the fund’s underlying securities’ creditworthiness. Mutual fund investments are subject to market risks. please read the offer documents before Investing.