Covid's Return, What is this for the investor

I know this is a difficult time for all of us, when the spread of COVID is growing so fast and people are in a great panic about this pandemic. While the mortality rate is stable and in the same range, the market is not too worried about it! Lack of drugs, oxygen and hospitals are still the main concerns on investor street

I understand that everyone in the country can and can do details, so I would protect my family Let in your Financial Products moderator and in your care, I would like to share my composure

Maintain a buy or hold stand in terms of existing MF or Stocks Portfolio

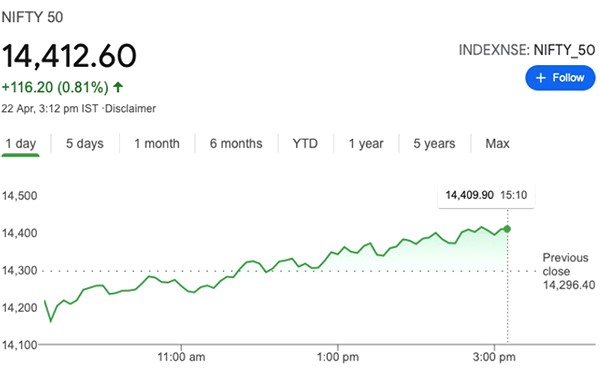

As we Know, fall is temporary but growth is permanent . So any fall in stock prices or Mutual Fund NAV, is just a matter of temporary fear. If you are invested in right business or equities then don’t worry – this fall is just an opportunity for you. Because the analyst and traders track only one thing – the net Death ratio ! And you will be happy to know that the Recovery ratio is still close to 98 or 99%. Since there are larger number of infected people , the death numbers are also appearing to be large – however the ratio is still the same . This is the reason, market recovered in today’s trade ( 22nd April 2021- Thursday)

Check your Life Insurance and Health Policies properly and realign according to the situation.

This is the crucial time when you should check your insurance policies, both life and health. These policies must cover COVID death and COVID treatment. Please feel free to speak with us to explore convenient and relevant policies based on your needs. As a general advice, we ask all our clients to add to their Term Policy to increase coverage and they should purchase a good Medical Policy with higher coverage.

• Be careful and play carefully in terms of health, but be bold towards your Wealth

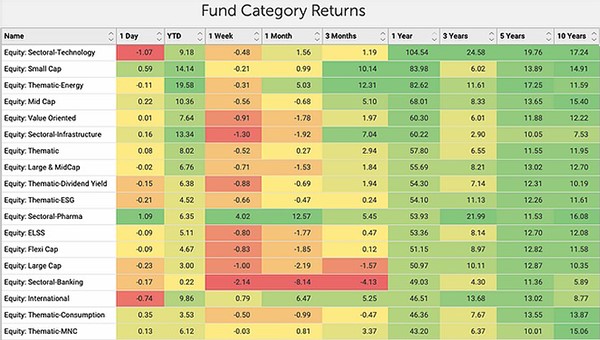

Equity is always best to generate above-average long-term returns. Historically, it can be seen that a good deal always generates a better return than any traditional fixed rate product. So capital is the best way to gather such deals in your portfolio. Please read the best performing stock categories under mutual funds.

The above chart is sorted by 1-year yields; As you can see, technology is the best leverage in the category, and small businesses perform well in both small-cap and mid-cap categories in these volatile conditions.

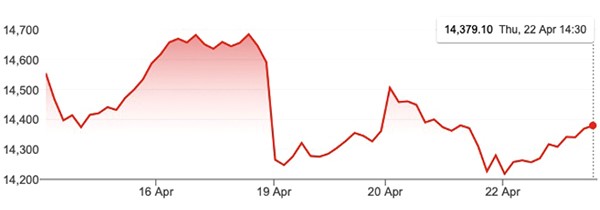

From week to week, the market goes through a volatile phase (as shown in the figure below). But you have to play boldly, continue with SIP, or invest extra money to take advantage of these temporary fears in the marketplace.

Stock market performance over last 4 days